You're Not Data-Poor, You're Insight-Poor

Whether you're drowning in data or operating in a vacuum, most manufacturers are starving for the one thing that drives decisions: clarity.

PLC and SCADA systems track sensor values and cycle times. ERP systems capture production volumes. Quality systems document defects. The spreadsheets pile up. The databases grow. Yet when critical decisions need to be made, managers still find themselves operating on intuition rather than insight.

Production counts scribbled on clipboards. Downtime logged in notebooks—when it gets logged at all. The shift handoff is a verbal summary. There is no shortage of activity, but virtually nothing is captured in a way that is searchable or actionable.

Whether you're drowning in data or operating in a data vacuum, most manufacturers are starving for clarity.

Siloed Systems

& Data Static

For those without systematic data collection, the path forward starts with capturing the basics: what ran, for how long, and what stopped it.

For organizations that have invested in monitoring, the challenge is different. The problem isn't collection—it is understanding and accessibility. Data sitting in siloed systems or exported to static reports once a week creates two problems simultaneously.

No Real-Time Response

Data cannot enable immediate action when production issues require a real-time response. By the time it's read, the moment has passed.

No Long-Term Intelligence

When data isn't structured for analysis over time, you lose the ability to surface insights that drive strategic decisions worth millions.

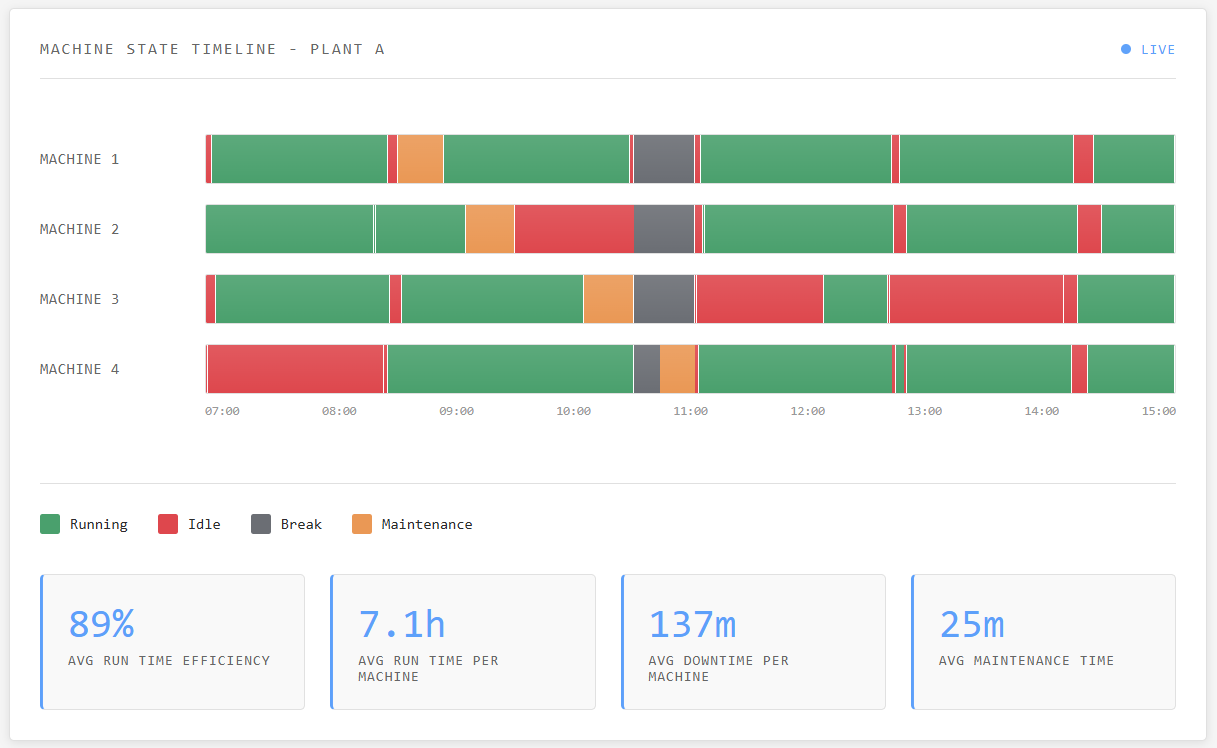

Real-time shop floor monitoring solves both problems. It transforms data from historical records—or creates it from scratch—into an operational tool while simultaneously building a strategic asset for the future.

For facilities starting without systematic data collection, the value is foundational: finally gaining visibility into what's actually happening on the floor. For those with existing infrastructure, the transformation is about speed and depth.

Intervene Early, Not Late

When downtime data flows immediately to supervisors, they intervene early rather than discovering problems late in a shift—or worse, in tomorrow's meeting.

Proactive Over Reactive Maintenance

When maintenance data reveals which machines are consistently down and why, your team acts proactively rather than chasing breakdowns.

Reallocate While There's Still Time

When performance data reveals a line is behind schedule just 2 hours in, there is still time to reallocate resources and recover the shift.

Real-Time

Monitoring

Compounding

Value

The real-time interventions deliver measurable value from day one. But the compounding value comes from what happens over months and years.

That same downtime and performance data, when preserved with context and analyzed longitudinally, reveals whether you have capacity constraints or execution problems—insights worth millions in capital allocation decisions.

Immediate Visibility

See what's actually happening on the floor in real time. Respond to issues as they emerge. Stop discovering problems after the fact.

Pattern Recognition

Historical production times with context enable predictive modeling for scheduling, quoting, and cost-to-serve analytics.

Strategic Intelligence

Longitudinal analysis reveals capacity versus execution realities—informing capital expenditure decisions and reshaping long-term strategy.

The manufacturers winning today aren't those with the most data. They are the ones who have built systems that serve dual purposes: enabling immediate action today while accumulating strategic intelligence for tomorrow.

They stopped asking "what happened last month?"

Your shop floor can generate the insights you need.

Whether you're starting with whiteboards and clipboards or wrestling with disconnected systems—the question is whether you're structured to capture, act, and compound.

Let's Talk →