Insurance incumbents are losing market share to tech-savvy competitors, and these new players are changing the game with customers. If you want to retain or grow market share in 2021, you need to be thinking about the following technologies.

"From 1965 to 2012, the ‘topple rate,’ at which incumbents lost leadership positions due to digital disruption, increased by almost 40%" - McKinsey & Co.

Traditionally, insurance companies use data as a competitive edge, but having a data analytics team is no longer enough. Even as you read this, new customer-centric, mobile-first technologies are attracting customers to companies like Tesla, Lemonade Insurance, and other tech-savvy competitors.

Ask yourself - is your company:

- Removing barriers so customers may quickly access the insurance products they need?

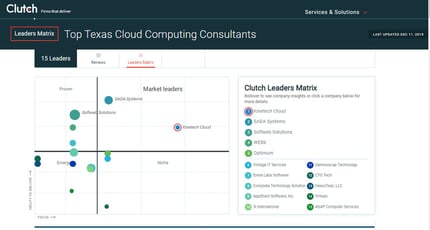

- Investing in cloud & mobile technology that will delight your customer?

- Rapidly gaining market share and attracting new policyholders?

- Using a data analysis method that was established more than five years ago?

We have recently created a whitepaper that explores technologies that build trust, make processes easier, or provide greater transparency to customers in the insurance industry.

From data strategies that remove the risk out of assessment while allowing you to deliver quotes faster to applications that can be deployed within a matter of weeks, these tech-based innovations can help you quickly rocket ahead of the competition.

.png?width=246&height=70&name=Kinetech%20PM%20246%20x%2070%20(1).png)