THE KINETECH FINTECH CLOUD

Transform Your Financial Services with Kinetech's Digital Banking Solutions

Cloud native applications for banks, credit unions, originators, and innovators - future proofed with low-code. Regain control of your digital experiences for Loan Servicing Lending, and Onboarding. Incorporate new technology (AI/ Machine Learning), extend core systems, control origination workflows, audit diligence performance, and more.

Kinetech is featured in the Q3 2024 Commercial Banking Fintech Spotlight by Datos Insights. Our low-code, cloud-native solutions help banks and credit unions modernize client onboarding and loan origination efficiently. Read the excerpt now to learn more.

Kinetech is proud to announce the availability of our Mendix Expert Development Services, Mendix Assessment and Roadmap Services, and our Mendix Audit and Remediation Services on the Amazon Web Services (AWS) Marketplace.

Kinetech works with THE leading low-code provider as judged by completeness of vision and ability to execute.

Read the latest report on low-code from leading industry analysts.

Ensure an exceptional digital experience with seamless engagement for all users.

Discover how our Digital Experience Evaluation offers insights and recommendations to enhance your customer's journey.

Join our upcoming webinar Nov 21st at 10 am EST where we will discuss practical applications of AI in financial services. Solidify your technical / AI vocabulary and then watch actual use cases of AI in the context of financial services.

This webinar is tailored for banking professionals who want to deploy tangible AI solutions in the next 12 months or less.

Future Proof with Kinetech's Banking Solutions

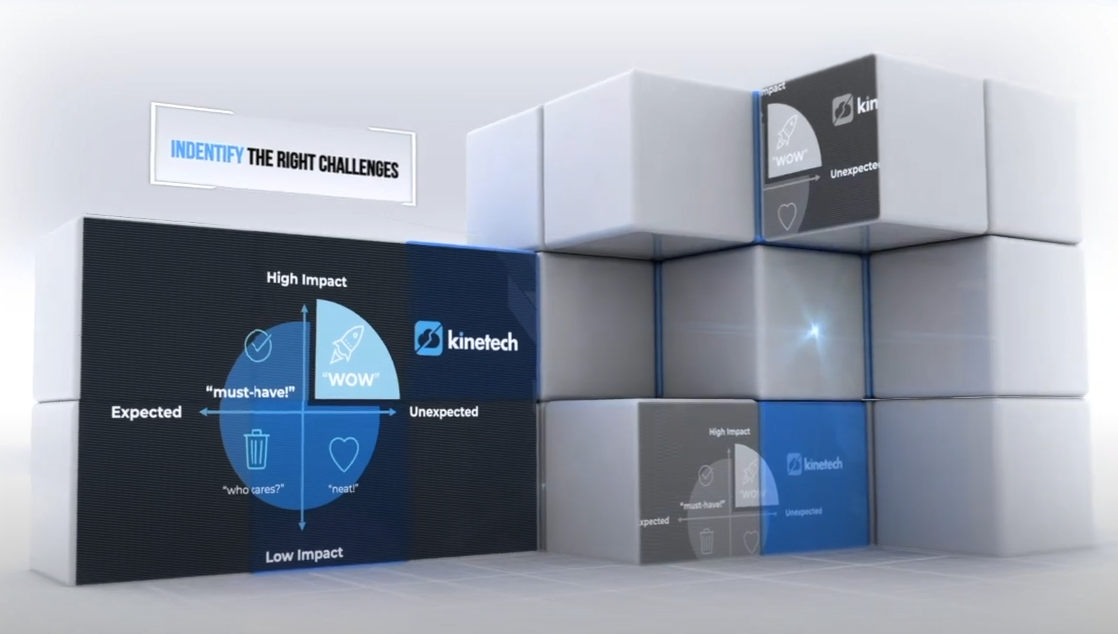

The urgency to control digital experiences from onboarding to origination, and back office operations has become imperative for financial service firms in today's market.

To solve these challenges you need a platform and partner that accelerates speed to market, enhances experiences, lowers cost, and improves agility.

You need Kinetech & our composable approach.

-1.png?width=1003&height=664&name=Group%2012%20(1)-1.png)

Composable Loan Origination Solutions

.png?width=120&height=120&name=Housing%20(1).png)

.png?width=120&height=120&name=people@1x-1.0s-200px-200px%20(1).png)

Onboarding Solutions

A consolidated onboarding solution to handle both your retail and business customers. Efficient onboarding is key for speed to revenue and increased customer satisfaction. Select either a phased replacement or a complete transformation of both your retail and business onboard platforms. Kinetech will enable your team to implement quickly and efficiently!

Deploy quickly, win market share, and accelerate time to value. When technology is equal, community and regional banks have the advantage.

Retail Onboarding

Retail onboarding presents challenges such as identity verification, regulatory adherence, product enrollment, and integrating diverse customer data. A versatile, low-code solution can simplify these procedures, bolster security measures, and deliver a smooth, efficient onboarding experience for customers.

Commercial Onboarding

Commercial onboarding increases the complexity and faces challenges with enhanced due diligence, regulatory compliance, product/service enrollments, and complex data integration. A composable, low-code solution can streamline these processes, enhance security, and ensure a seamless, efficient client experience.

Kinetech FinTech Cloud

Discover how the Kinetech Fintech Cloud empowers community and regional banks to deliver exceptional digital experiences, grow revenue, and cut costs—watch now to see how we level the playing field with national banks.

When technology is equal, community and regional banks win.

5 Things You Should Know About Low-Code for Financial Services Digital Transformation

Compliance Complaint Tracking

If your bank is still using spreadsheets and emails to manage customer complaints, this solution is built for you. Easily integrate this purpose built application into your core system (Jack Henry Silverlake, Fiserv, or FIS) and save thousands of dollars in lost worker productivity.

The Composable Enterprise

Financial Services firms are under constant pressure to drive efficiency, create differentiated product offerings, and amazing customer experiences - all while staying in compliance. Mendix is the leading best of breed low-code platform - featured in the AWS re-invent keynote, and recognized by Gartner and Forrester as a proven option for most modernization projects.

Mendix allows you to build web and mobile applications, automate business processes, and improve digital experiences 5-10x faster than other methods with up to 70% fewer people. This results in a double compounding effect of (1) time to value and (2) less personnel required. Its cloud native / cloud agnostic architecture enables your organization to deploy future-proof digital applications in any public or private cloud environment.

Fiduciary Financial Advice with GuidedChoice

Global liquid assets (wealth management) is expected to balloon to $320 Trillion USD by 2030, according to The Economist; putting an estimated $100 Trillion up for grabs.

Grow revenue and claim market share with retail investors by deploying your institution's branding with intelligent and automated fiduciary compliant financial advice & education.

Our financial advice and education services are based on Harry Markowitz Portfolio Theory and powered by GuidedChoice.

Supercharge YOUR Digital Transformation. Our Proven Path to Success.

Kinetech's Mendix Enablement Practice is your strategic partner for unlocking the full potential of low-code digital transformation. With certified experts, a proven 4-phase execution strategy, and personalized support, we empower your organization to excel in the world of Mendix.

.png?width=700&height=540&name=4PS-1-removebg-preview%20(2).png)

Breaking from the Pack with Mobile Banking App Development

Discover how leading financial institutions are transforming their services through cutting-edge mobile banking app development.

.png?width=500&height=676&name=image%20(200).png)

Our Partners

-

Mendix

Mendix -

SAP

SAP -

Siemens

Siemens -

.png?width=960&height=540&name=AWS%20Logo%20-%20Resize%20(1).png) AWS

AWS -

.png?width=246&height=70&name=Kinetech%20PM%20246%20x%2070%20(1).png)