Throughout my financial services career over the past 25 years, we have experienced financial market volatility not seen since World War II in the 1940s. We have had the Dotcom boom and bust, the housing crisis that rocked the global markets, and a global pandemic just to list major financial events. As geopolitical crises ebb and flow, what can we learn from the past that can inform our decision-making in the future?

The demand and the need for expert financial advice and education is higher than ever. Yet the common retail banking customer has little or no options for help in financial planning as nearly all bank advisory services are focused on high net-worth individuals; the top 5% of customers. The reasons for this are varied, ranging from the 80/20 rule (80% revenue generated from 20% of customers), scarcity of talent (costly to hire/ retain Certified Financial Advisors (CFAs)), and return on investment (too costly to provide services to all customers).

A Path Forward:

Technology changes all of that. Community and regional banks now have a Financial Advice and Education solution to offer the other 95% of underserved retail customers that is complementary to their Wealth Management services. This solution is Digital Investment Advice and Financial Planning tools that extend the bank's sophisticated wealth management services to all of its retail customer base in a cost-effective manner.

This is possible through the partnership of Kinetech and GuidedChoice.

For those not familiar, GuidedChoice was co-founded by Harry Markowitz, the Nobel prize-winning father of Modern Portfolio Theory and The Efficient Frontier. In short, the GuidedChoice financial advice ‘brain’ with Kinetech’s customization, branding, and scalability empower firms looking to serve the underserved.

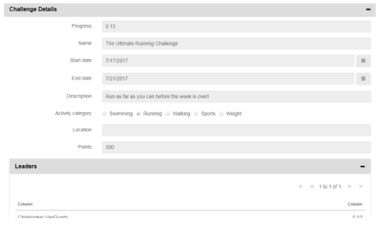

Let's take a closer look...

Dr. Harry Markowitz 1927-2023

Closing the Gap in Access to Financial Planning

Financial freedom is desirable to a large percentage of the population. Unfortunately, the reality for the majority of people in the United States is far from that ideal. In fact, recent research from LendingClub finds that 61% of adults were living paycheck to paycheck as of July 2023, a two-point increase from the previous year. Currently, over 60% of Americans do not receive any professional financial advice or education.

Traditionally, wealth management services are catered to clients who reach a minimum account size of $500,000+, or the top 5%. The rationale behind serving only clients with such a high threshold is to justify the cost of maintaining a professional wealth management team to provide one-on-one services that high-net-worth individuals require. This is a common pain point for regional and community banks who wish to extend sophisticated financial planning services to customers below the $500k account threshold, but have been unable to do so until now

The only way to provide sophisticated wealth management services profitably to the other 95% is through a digital solution where no account minimum threshold would be required by the bank.

Extending Wealth Management services to all of the bank’s customers, not just the top 5%, allows full relationship engagement through the life journey of each and every customer.

Not only is it the right thing to do, it simply makes smart business sense (and cents). We have an obligation to use advancing technology to empower everyone to make smarter financial decisions...not just the top 5%.

Fiduciary-Compliant Digital Advisory Solutions

The solution is simple - a digital investment advice and education platform that bridges the gap between the highest net worth clients and those under or near the minimum threshold.

Banks may choose to cover the cost for or partially subsidize the service as a "Value Add" service. Alternatively, they may charge customers for the investment advice, treating it as a new revenue stream while taking a win-win managed account approach.

Traditional wealth management for high net-worth individuals will always require intensive expert consultations. Wills, trusts, life insurance, and other sophisticated products like FLPs and GRATs are based on unique circumstances. But sound financial advice for public markets is now available via this digital solution and may be extended to the organization’s entire customer base.

Customer retention, growing assets under management (AUM), and Return on Investment for Digital Advisory services are what are most attractive for the bank.

Take this simple example, only 5% of a bank’s 20,000 retail customers may be eligible for the traditional wealth management program leaving 19,000 unserved. With the Kinetech / GuidedChoice Digital Advice and Education service, the bank would break even with only 10% of retailed customers enrolled or subscribed. Enrolling 20% of your retail customers would achieve 50% ROI. The goal of the program should be to enroll a majority of your retail customers into the digital wealth program.

.png?width=595&height=327&name=image%20(23).png)

This is where the partnership between Kinetech and GuidedChoice shines. When technology is equal, regional and community banks have the advantage. Banks and their customers want a digital experience that is representative of the bank’s unique brand. This differentiation is what draws in customers and keeps banks competitive - well within the capabilities of Kinetech.

The collaboration between Kinetech’s FinTech Cloud and GuidedChoice revolutionizes the delivery of financial advice and education. It empowers banks to serve all customers, regardless of their account size, and create unique, branded digital experiences. This partnership marks a significant step towards democratizing financial advice and education, ensuring that every individual can make informed decisions about their financial future. What makes this even more compelling is that the digital advisory and education platform can be implemented in as little as 90 days.

When you do the same thing as everyone else, distinguishing yourself becomes significantly harder.

The same goes for using the same software or technology.

How Kinetech Helps You

Kinetech provides a white-label and/or customized experience for banks, offering a full suite of digital financial advice and education services that can be tailored to meet their customers' needs. The bank is in control through our composable applications. Services may be consumed as independent solutions that integrate with your banking core (Jack Henry Silverlake, Fiserv, and FIS) or bundled to help you leapfrog the competition.

The Kinetech FinTech Cloud is dedicated to serving those within the financial services industry and offers banks access to industry-focused best practices and the people who create them. Our integrated cloud software connects customers to partners with applications dedicated to helping with things such as Loan Origination, Institution Onboarding, Compliance Tracker, Electronic Signature, Mobile Applications, and Specialty Products.

If you are ready to harness the power of low-code for your financial institution, be sure to check out my latest blog, “5 Things You Should Know About Low-Code for Financial Services Digital Transformation,” to kickstart your digital transformation journey.

Get Started Today

We are immersed in the rapidly changing world of financial services, and a big part is the demand for expert financial advice and education. Traditional approaches are leaving many underserved and challenges unresolved. Secure your bank's future by considering a new approach to wealth management via the Kinetech FinTech cloud and our GuidedChoice-powered Financial education and advice offering. Connect with us today to explore these transformative possibilities and create a more inclusive financial future.

____

About Kinetech:

Kinetech is the leading developer of Low-Code, cloud-native, digital experience, automation, and core systems software applications for the financial industry. With over 10 years of Mendix implementation experience, the highest concentration of advanced Mendix developers in the United States, and the strongest track record of customer success, you can be confident partnering with us on your most important modernization initiatives. Our composable service offerings are configured and integrated with other web services (APIs), platforms, and enterprise applications.

About GuidedChoice

GuidedChoice is a digital financial advisory firm and independent fiduciary that has served over three million people and more than 70k plans while providing investment advice and financial wellness solutions for well over two decades. Using rigorous methodology and advanced scenario planning tools, we provide personalized, prudent, and actionable financial advice to and through retirement. Financial freedom means being stress-free when it comes to your money. No matter how much money you make or want to save for retirement GuidedChoice can help.

1 https://en.wikipedia.org/wiki/Harry_Markowitz

2 https://fortune.com/2023/08/31/americans-living-paycheck-to-paycheck-two-thirds-lendingclub/

.png?width=246&height=70&name=Kinetech%20PM%20246%20x%2070%20(1).png)