When I began a significant digital transformation project for a regional U.S. bank, low-code technology was not on my radar, and the financial services industry had yet to embrace it. I unknowingly was navigating my career with essentially “one arm tied behind my back."

Digital transformation in the Financial Services industry is daunting, often involving a costly and time-consuming replacement of old systems. Decision-makers usually opt for familiar off-the-shelf solutions, which is exactly what I did with a seven-figure budget at this regional bank in 2017. While this approach was successful at the time, there could have been a way to do that same transformation smarter and with fewer resources.

Fast forward to 2021, and I discovered the compounding benefits of low-code development and realized that it is not off-limits to the financial services industry. Instead, this new approach could solve many challenges and could have assisted me in 2017. Since then, the technology has only gotten better. In this blog, I'll share how low-code can revolutionize the financial sector's digital journey and what you should know as you embark on your transformation.

1. Low-code is Accessible to Financial Services.

While low-code might not be on every financial institution's radar, it's an opportunity for industry innovators to lead the way and laggards to leapfrog the competition. Low-code is still the best-kept secret in enterprise software, but all platforms are not created equal

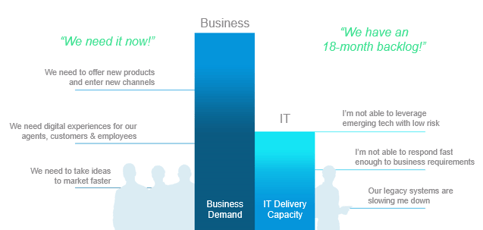

Traditionally, roadmaps for digital transformation hinged on the tried and true practices of the past. Nobody ever got fired for buying IBM right!? By leveraging the strategies in place for many years, organizations face limitations around costs, resources, the balancing act of IT vs. business needs, and the maintenance of legacy systems. If you do everything the same, it is difficult to be different.

Low-code, as offered by Kinetech, can help banks and other financial institutions truly innovate during their digital transformation. This can be used to develop a myriad of applications dedicated to addressing internal needs but also applications aimed at improving customer experience, which is crucial. With a low-code approach, you can do this at speeds and costs that traditional development simply can not match.

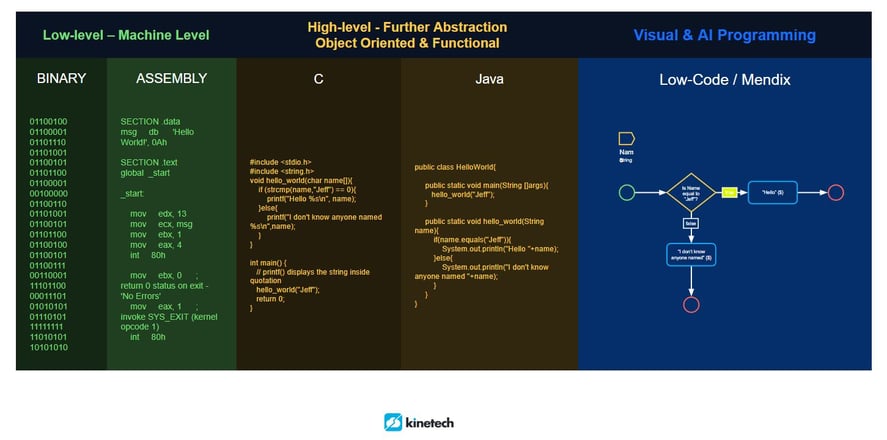

The low-code platform Kinetech leverages, Mendix, makes development a visual process with high levels of abstraction and automation. The development process with Kinetech leaves the waterfall methodology in the past and evolves into an agile, collaborative, iterative project with fast results and unmatched customer satisfaction.

Kinetech then takes this one step further with the Kinetech FinTech Cloud™. The FinTech Cloud is a set of connectors, solution accelerators, and Mendix components that accelerate your time to value. These composable applications and solution accelerators set the benchmark for microservice architecture, as well as customer and employee experiences. This integrated micro-service architecture connects customers to partners with applications that extend core systems such as:

- Origination workflows

- Institution Onboarding

- Compliance Tracker

- Electronic Signature

- Mobile Applications

- Specialty Products

2. Low-code is Flexible and Relevant

Off-the-shelf software serves a clear purpose: to solve common / specific and recurring problems. The fact is that off-the-shelf software does not offer any true differentiation. If you are using it, your competitors likely are as well, meaning customer experience will not vary between institutions.

Differentiation in customer experience starts with the software itself and is a true game-changer in this industry. The low-code approach Kinetech offers can create a truly tailored experience making you stand out from the competition while addressing nearly any need you may have. All of the 'wish list' projects are now only weeks to months away, giving you an unparalleled opportunity to leapfrog your competitors - just see our recent cases for Go-Fi (custom auto-origination and financing in 5 months) and eXp (expanded to 14 countries in 12 months).

3. Low-Code Saves You Time and Resources.

In financial services, when technology is equal, regional banks and credit unions have the advantage. Unfortunately, the regional banking sector is stuck between a rock and a hard place; between a challenging macro environment, well-funded competitors, nimble finTechs, and limited resources / budgets.

To digitally transform successfully you will need a disciplined, outcome-based approach.

The pace of change has never been this fast (thank you AI) and yet will likely never be this slow again. This confluence of factors is brewing a massive to-do list for everything from process automation to new applications to incorporating AI to improving customer-facing applications. This list (backlog) creates immense pressure on IT teams and that mandates a different approach.

A low-code approach allows you to check off more of these requirements faster and with the same budget or less.

4. Do More with a Tighter Budget.

In 2017, before I knew about low-code, I took the road most traveled and dedicated 12 months to selecting a vendor and another 3.5 years with a seven-figure cost per year until the system was implemented. I was stuck. My budget, resources, and focus remained dedicated to this project for 3.5 years.

In today’s world, the prioritization of resources while remaining agile is critical.

With Kinetech’s low-code approach, you can reduce the application development time by up to 90%. Your team will not only have a customized solution faster, but your institution will have the flexibility to move on to other priorities sooner.

5. Getting Started is Easy!

I know. Financial institutions are already over-leveraged. The idea of launching an entirely new technology is daunting at best. To help with this, Kinetech makes it easier with our Digital Execution Strategy. Embracing a digital strategy is more than simply buying a cloud-based software application. From our experience consulting with everyone from Fortune 500 companies to government institutions to startups, we have distilled a proven process that reduces the time to realize value and drives return on investment.

Kinetech also leverages Mendix templates to accelerate the process even further. These templates were created based on years of banking experience and provide a starting point to launch from and include everything from customer onboarding to loan origination, to native banking. Kinetech also builds templates in-house featuring solutions such as our compliance complaint tracker and fiduciary financial education and advice applications.

Now you know.

Had I used a low-code approach in 2017, I would have not only achieved my goals faster, but I would have been able to stretch my budget further. If you are considering a digital transformation, see Kinetech and the Mendix low-code platform as your goldilocks zone between a custom and off-the-shelf solution. Faster than off-the-shelf, fit-for-purpose, and composable for changing requirements.

I recommend starting small and building trust. Find a need that lives on your “nice to have” list where you can prove things out (low risk, high reward). Once you’ve seen the power of low-code and are moving forward, you can use this kinetic energy to move on to the big-ticket items. What gaps are in your current processes? Is there something you’ve been doing in Excel? Are your customers getting a sub-par experience? Kinetech is here to help.

Unveil the path to success for your financial institution by exploring the world of fintech challenges and Kinetech's solutions through our helpful one-pager or get in touch with the team today!

____

About Kinetech:

Kinetech is the leading developer of Low-Code, cloud-native, digital experience, automation, and core systems software applications for the financial, industrial, and public sectors. With over 10 years of Mendix implementation experience, the highest concentration of advanced Mendix developers in the United States, and the strongest track record of customer success, you can be confident partnering with us on your most important modernization initiatives. Our composable service offerings are configured and integrated with other web services (APIs), platforms, and enterprise applications.

Explore Our Digital Execution Strategy

Discover the framework behind our success. Dive into our Digital Execution approach to understand how we drive value and efficiency in our projects.

.png?width=246&height=70&name=Kinetech%20PM%20246%20x%2070%20(1).png)