Is your digital experience consistent across all of your customer products? Take a screenshot of each of your landing pages across your consumer, business, lending, and wealth customer experiences. Do they all appear to have the bank's standard "look and feel"? Does your bank even have a standard? If the answer is no, then you are failing your customers. Technology has been available to fix your digital experience.

If you are reading this article then you are likely either an “agent of change” or would like to be one for your bank or credit union. I have played the role of “Change Agent” several times in my career, both within a bank and also at one of the largest global Fintechs. Several aspects are interesting and unique about this position.

A primary component of a digital strategy for a bank or credit union is to establish a consistent digital experience for customers across all products. A vast majority of banks and credit unions fail to provide a consistent digital experience. It’s like driving around in a new car that’s got a smashed bumper. Yes, it is a great car that still gets you from Point A to Point B, but the only thing people look at is the smashed bumper.

So I ask you…What is the smashed bumper of your digital experience?

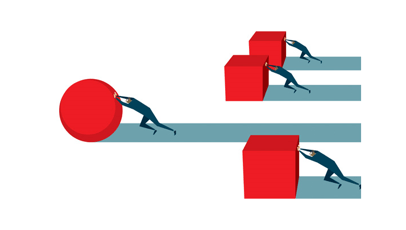

Typically, a “change agent” is recruited to solve a long-standing problem that has had numerous failed attempts. There is also a mandate to make the change that comes with the role, but it does have an expiration date. Inherent to being a change agent is that you will run up against the traditions of your financial institution and will have to persuade some people, yes even the leaders, who by the way probably hate change. This role is not for everyone as you must be patient to turn the tide of your bank or credit union’s culture. Finding a straightforward or “easy” solution to that challenge is rare and is the exception. Oftentimes, you have to start small. Address the challenges that perhaps do not require a complete digital transformation all at once, and build up from there. Build trust and look for the small win by changing a mobile experience that is “not responsive”, i.e. doesn’t automatically resize the screen to their device. Because of the numerous third-party platforms integrated, you likely have some branches of your mobile experience that are…to put it bluntly, horrible. Transform one step at a time.

Starting Small:

A great case study of this is Jack Henry’s iPay. When Jack Henry acquired iPay and rolled their bill pay into it, it was a logical step to give businesses and consumers the ability to easily pay bills, transfer money, manage payroll, and more. As to be expected with any platform that has existed for over 15 years, it is very challenging to keep up. The demands on a technology provider to maintain a great mobile experience along with any device a customer may use to access your bank or credit union’s products and services. Jack Henry should be commended for enabling APIs to allow those who want to provide a great mobile experience to take control. This is the way the world is moving…

.png?width=249&height=469&name=Group%204%20(2).png)

This is an example of an unresponsive webpage on a mobile device.

Banks and credit unions want or should want to control their customer’s digital experience. This is where Kinetech truly shines, as we are equipped with an experienced, expert team to help banks and credit unions do just that - take control.

Navigating Challenges:

After the purchase of IPay, the integration journey unfolded with challenges. Having first-hand experience with this, one of the businesses I was part of utilized Jack Henry's small business cash management platform, and just like with any platform or off-the-shelf solution there were a few gaps we needed to fill. This prompted a shift to the top third-party provider for business management. However, this transition left a void in bill pay capabilities, especially crucial for the majority of small businesses. This need for bill pay capabilities outside of a core management platform was something many businesses aside from the one I was employed at were facing, and continue to manage today.

The challenges continued to emerge as mobile banking grew in popularity. IPay's integration into a native mobile app faced significant obstacles due to its non-responsive nature, leading to a disjointed user experience. Despite efforts to empower reselling, the lack of responsiveness persists for many banks and credit unions, demanding a solution to enhance user satisfaction.

The Missing API Piece:

While there is speculation around the existence of a fully developed API for IPay, the precise functionality of this critical element remains uncertain. Banks, regardless of their size, rely on online banking as a gateway to revenue-generating products like wires, transfers, and bill pay. The experience for the users must be smooth and simple. This is simply the expectation.

The Vision for Seamless Integration:

Enter Kinetech, envisioning a transformative module – a drag-and-drop solution to seamlessly integrate IPay into native mobile apps. The goal is clear – to bridge the gap between the unresponsive IPay mobile experience and a fully immersive app, tailored to each bank's unique requirements. This could be your first step to addressing customer experience at your financial institution.

The Unveiling of a Solution:

While the module is still in the conceptual phase, the potential benefits are immense. Imagine a banking landscape where users effortlessly navigate a responsive IPay, enhancing their overall banking experience. This can go even further than IPay, I implore you to push your imagination to see all of the opportunities to fix the broken things before rebuilding everything from the ground up. It may be as simple as a low-code composable application and approach.

Join the Revolution:

As we embark on this journey to redefine digital banking experiences, Kinetech invites forward-thinking banks to join the revolution. Be a part of shaping the future of seamless, responsive, and secure online transactions. Together, let's pave the way for a new era in digital banking.

.png?width=246&height=70&name=Kinetech%20PM%20246%20x%2070%20(1).png)